COMPANY PROFILE

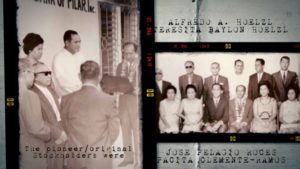

Founded in the year 1967 by Alfredo Alcazar Hoezl, a German- Spanish (Filipino by birth) and Jose P. Roces on January 7, 1967 in a laidback but economically significant coastal town of Pilar in Sorsogon, the Rural Bank of Pilar (Sorsogon), Inc. has been living true to its vision as a countryside banker excellently serving the constituents of the province of Bicol.

Despite the Bank Management’s prudence, frugality and tenacity since its inception in 1967, it went through various forms of regulatory, business and operational challenges. The operation of the Bank went on smoothly until 1987 when super typhoon “Sisang” hit the Bicol Region and adversely affected the Bank resulting to high past due loans and mounting bills payable that almost pushed the Bank to close its operations.

The Roces Family Group, headed by Engr. Orlando B. Roces, son of co-founder Jose P. Roces bought the other shares of stocks of the Bank and took over bank ownership. This move resulted to a total turn-around for the bank in all aspects, thereby bringing forth renewed strategic direction and vigor and enthusiasm to the bank’s team to move forward.

of stocks of the Bank and took over bank ownership. This move resulted to a total turn-around for the bank in all aspects, thereby bringing forth renewed strategic direction and vigor and enthusiasm to the bank’s team to move forward.

Now with more than 50 years of operation under its belt, Rural Bank of Pilar (Sorsogon), Inc. has been among the top-rated rural banks in the country. It has been sustaining high year-on-year CAMELS ratings from the Bangko Sentral ng Pilipinas. Furthermore, the Bank began to deliver to its growth and expansion goals through its branching initiatives. Currently, the Bank has three (3) branches and four (4) Branch-lite Units (BLUs) with strong presence within Sorsogon and Albay provinces.

For the years ahead, the Rural Bank of Pilar (Sorsogon), Inc. has always been a bank of possibilities. Its dreams and aspirations are planned to be better realized by further building and maintaining excellent operational and administrative machinery to be all wrapped in an open innovation environment that bring about fresh ideas and breakthrough thinking as its ever-proactive prime movers continue to rethink how they live and work and bring people together, making them more collaborative and productive to drive innovation.

For the years ahead, the Rural Bank of Pilar (Sorsogon), Inc. has always been a bank of possibilities. Its dreams and aspirations are planned to be better realized by further building and maintaining excellent operational and administrative machinery to be all wrapped in an open innovation environment that bring about fresh ideas and breakthrough thinking as its ever-proactive prime movers continue to rethink how they live and work and bring people together, making them more collaborative and productive to drive innovation.

RBPI has been under the regulatory supervision of the Bangko Sentral ng Pilipinas (BSP), and Philippine Deposit Insurance Corporation (PDIC), and the Securities and Exchange Commission; and a consistently active and member of good standing of the Rural Bankers Association of the Philippines (RBAP).