Due to the proliferation and stiff competition with other financial institutions in selling the microfinance product, the Rural Bank of Pilar (Sorsogon), Inc. has crafted an enhanced incentive program for microfinance borrowers. The invasion of commercial banks in the countryside as well as escalates the threats and has then prompted the Bank to come up with solutions.

To address this concern, a microfinance incentive program for the Bank’s clients was created to improve sales and marketing efforts of the Bank.

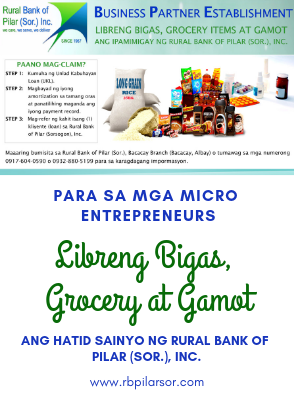

Unlad Kabuhayan Loan (Microfinance Loan) borrowers who have not missed a single payment in their previous loan cycle are qualified for the incentive. The client has the option to choose from among the three choices of incentive products (groceries, medicines or a bag of rice). The amount or worth of the product chosen will depend on the amount of loan previously availed. The Bank’s clients may claim their incentives from any accredited Business Partner Establishment (BPE) located in Pilar, Donsol, Cumadcad, Bacacay, and Tabaco.

This promo is effective from October 2, 2017, onwards. Interested clients are invited to visit the Rural Bank of Pilar (Sorsogon), Inc. branch office near them for more information!

Hannah F. Fabellore | Marketing Unit